tn franchise and excise tax guide

Franchise Excise Tax - Excise Tax. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

These entities that are subject to the franchise or excise tax must file their own separate franchise and excise tax return.

. Avalara excise tax solutions take the headache out of rate determination and compliance. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. Franchise and Excise Taxes The Franchise Tax continued that standing alone is subject to the Effective for tax periods beginning on or Tennessee franchise tax.

Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. Ad Access Tax Forms. Tennessee franchise and excise tax guide tenn.

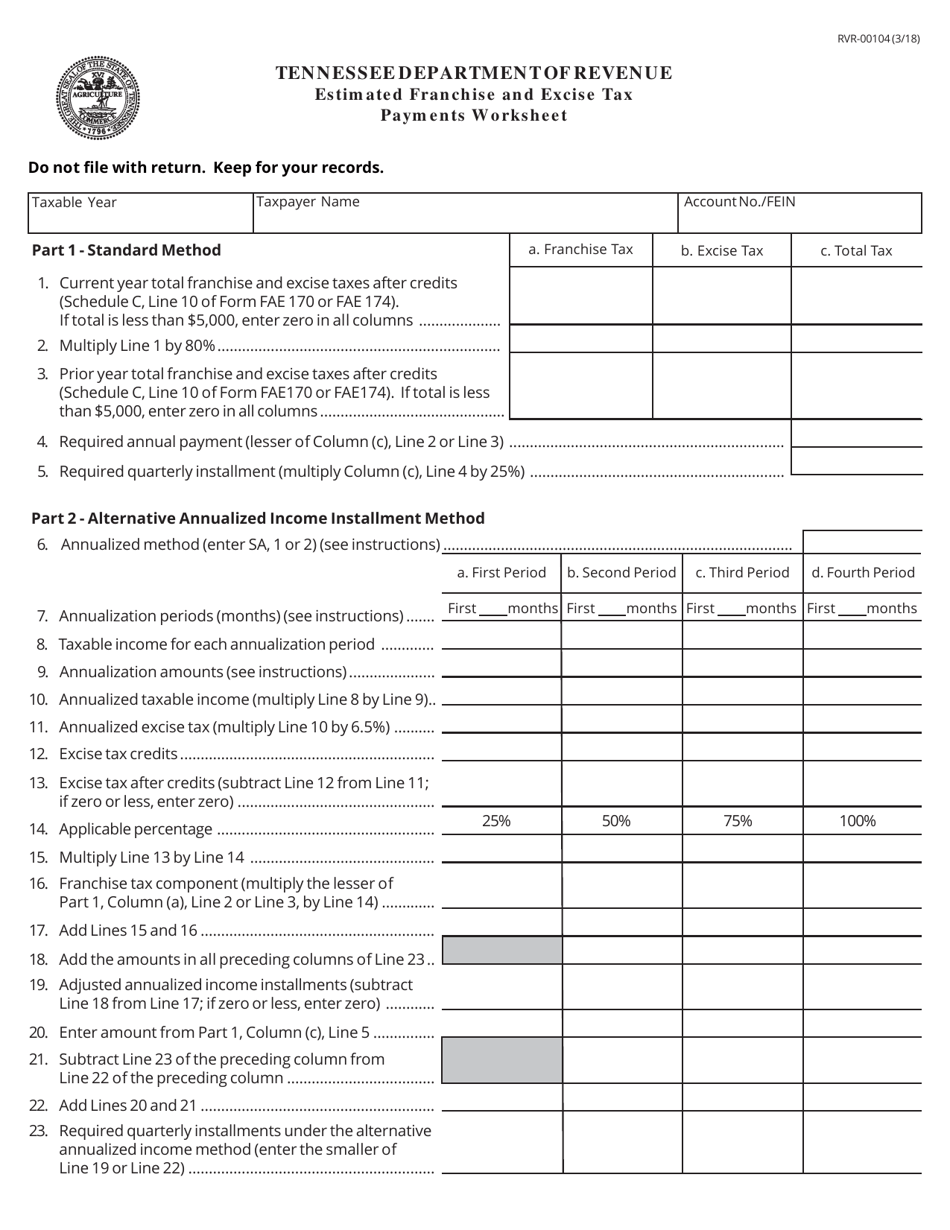

Quarterly payments of estimated franchise and excise tax are made according to the schedule below. Proprietorships are not subject to these taxes. Franchise Excise Tax - Franchise Tax.

The excise tax is 65 of the. Avalara excise tax solutions take the headache out of rate determination and compliance. 2 All other after January.

The excise tax is. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting.

The excise tax is based on net earnings or income for the tax year. Excise tax 65 of. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property.

If you had a franchise excise tax account number before May 28 2018 the only change to this number is the addition a zero to the beginning of the number. The franchise tax is computed based on 025 of the greater of net worth or real and tangible property in Tennessee. For more information view the topics below.

FE-5 - Due Date for Filing Form FAE170 and Online Filing. The Tennessee Franchise and Excise tax has two levels. Important Notice 13-16 Single.

All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business. Ad Use Avalara to automatically determine excise tax rates for a variety of energy products. The franchise tax is an asset based tax on the greater of net worth of.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The excerpts from the Tennessee Code are through the 2020 legislative session. For any LLC registered and operating in the state of Tennessee it is important to pay the franchise and excise tax.

Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an. FE Credit-1 - Tax Credits are Claimed by the Entity That Earned Them. Most other guidance on corporations are distributed in the franchise guide you.

The minimum tax is 100. The excise tax is based on net earnings or. Ad Use Avalara to automatically determine excise tax rates for a variety of energy products.

Open the form in the online. 025 per 100 based on either the fixed asset or equity of the. FE Credit-2 - Broadband Internet Access Credit Repealed.

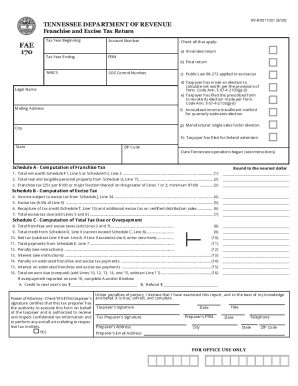

Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. Select the form you need in our library of legal forms. Taxpayer will be tennessee franchise franchiser disclosure of of useful tools to guide to debt.

The information provided in the Departments tax manuals is general in nature. The excise tax is based on the net income of the company for the tax year. All entities doing business in Tennessee and.

Complete Edit or Print Tax Forms Instantly. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. The minimum franchise tax is 100.

The franchise tax is applied on either the book value of the. FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership. The term quarterly is used because there are four payments due.

65 excise tax on the net earnings of the entity and.

Amended Florida Corporate Income Franchise And Emergency Excise Tax

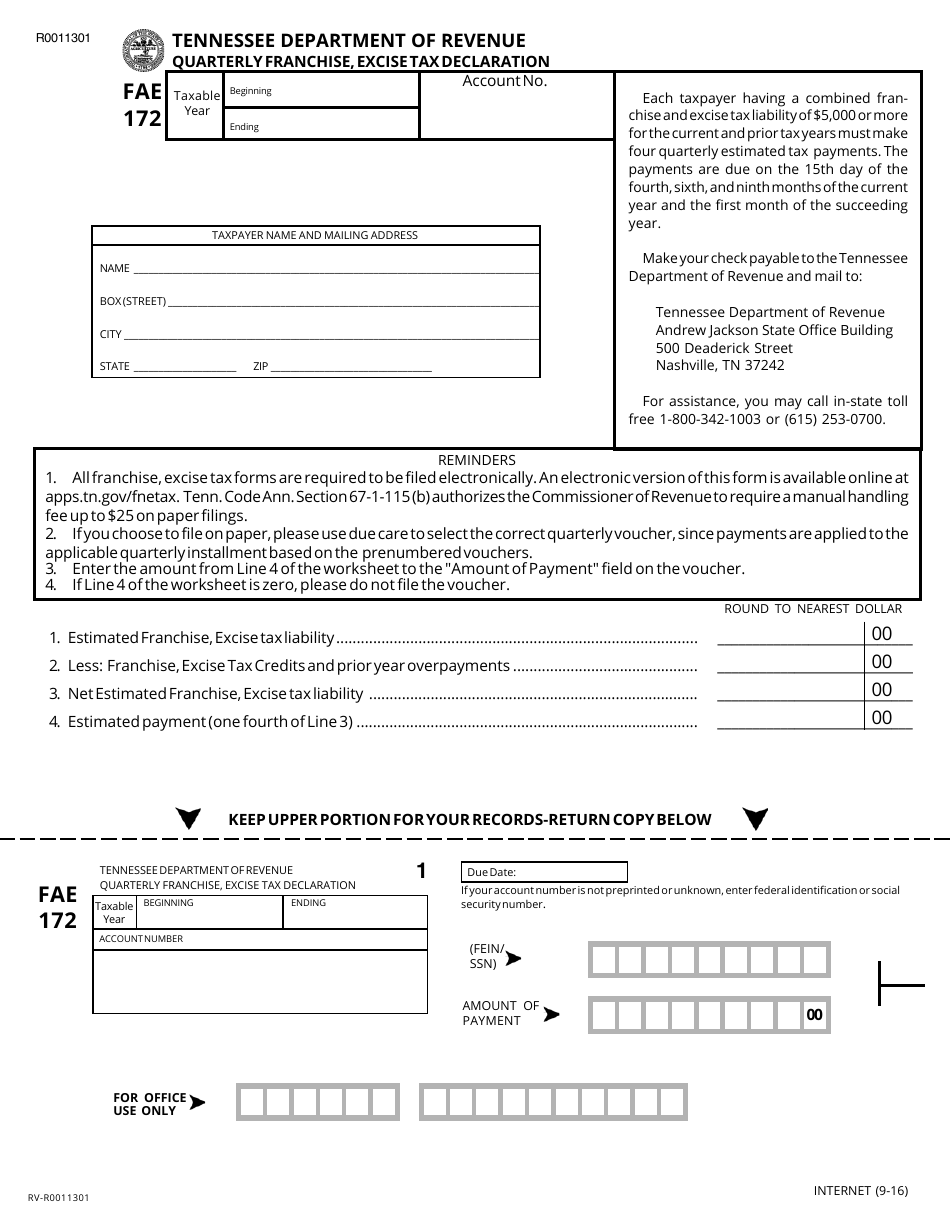

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tennessee Franchise And Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

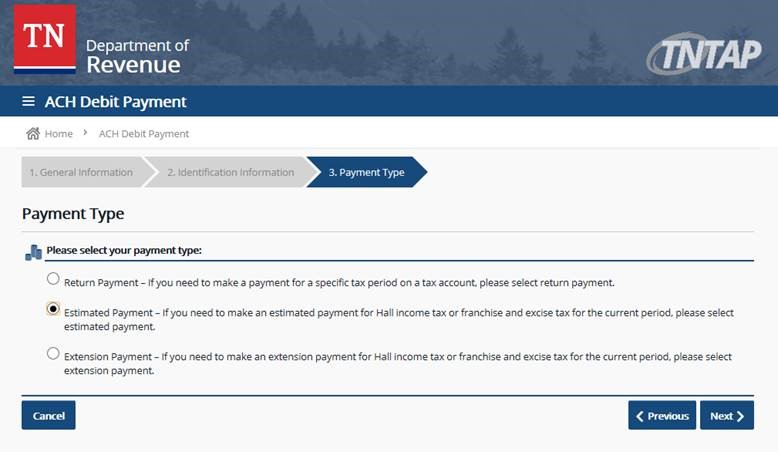

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tennessee Franchise Excise Tax Price Cpas

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube

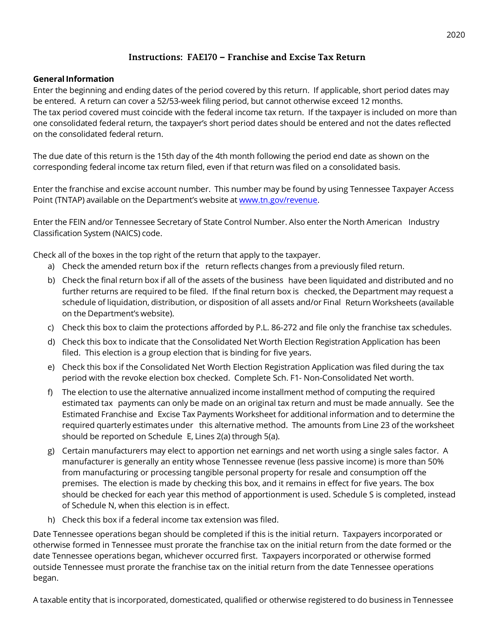

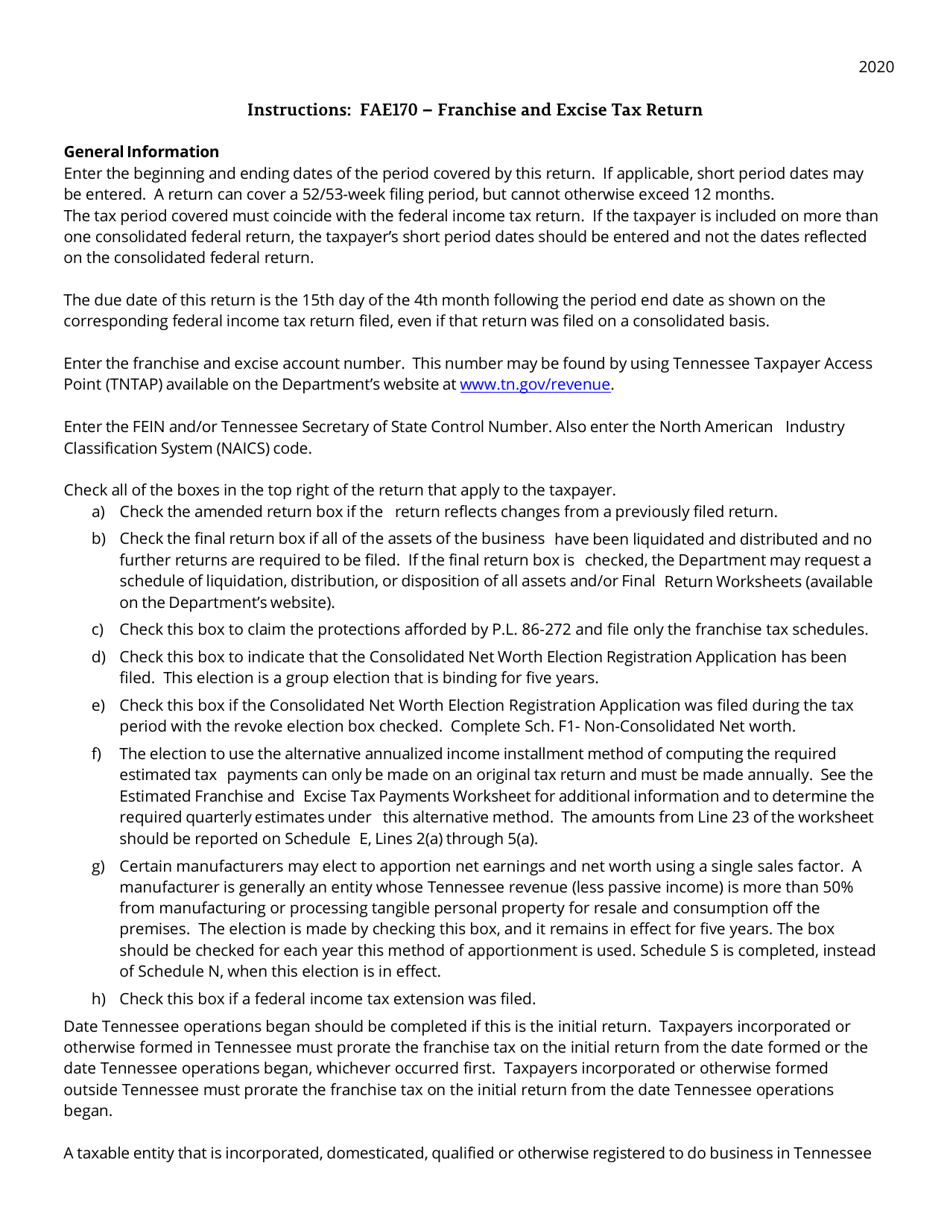

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fae172 Fae 172 Quarterly Franchise Excise Tax Declaration State Tn Fill And Sign Printable Template Online Us Legal Forms

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Form Rvr 00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller